How to Start a Nonprofit Organization: A Step-by-Step Guide

If you care deeply about your community and enacting positive change within it, the idea of starting a nonprofit organization has likely crossed your mind.

After all, nonprofits can be incredibly effective vehicles for positive change. For example, charity: water, an organization focused on helping people gain access to clean drinking water, has funded nearly 112,000 water projects, serving 15 million people across 29 countries since its founding in 2006. Similarly, the American Heart Association trains 22 million people to conduct CPR each year, and has invested $5 billion dollars in heart disease and stroke research since 1949.

People who work in the mission-driven nonprofit sector generally enjoy what they do. According to research conducted by Classy, 84% of nonprofit employees are satisfied with their jobs.

Clearly, being involved in nonprofit work can be deeply rewarding and can drive real change for people in need. But starting a nonprofit can be a complicated process, one that requires careful planning and navigation of legal requirements for tax-exempt organizations.

This guide will serve as your definitive resource to learn how to start a nonprofit organization, walking you through everything you need to know to get your own organization up and running. Specifically, we’ll cover:

If you think that starting a nonprofit is right for you, this is the guide that can help take you from a great idea to a full-fledged operation. Let’s go!

7 Steps to Starting a Nonprofit Organization

Setting up a nonprofit doesn’t happen overnight. In fact, without the right approach, founded in thorough research and careful attention to legal requirements, your nonprofit will struggle to cut through red tape to get to the work that really matters. Follow these steps to start off on the right foot.

1. Conduct research on need and feasibility.

If you’re considering forming a nonprofit, you probably already have a good idea of the cause you want to champion and the population you want to serve. But it’s important to note that you won’t be creating your nonprofit in a vacuum. In fact, according to the National Center for Charitable Statistics, there are more than 1.5 million nonprofits in the U.S. alone, which means that there’s likely an organization out there with a mission similar to the one you’re envisioning for your nonprofit.

Don’t let this news discourage you—there are a wide variety of ways to approach nonprofit work, and your nonprofit could have a unique approach that drives impressive impact for your intended constituents. But, to be sure that starting a nonprofit is the best way to tackle the issue you’re seeing in your community—and to make sure that your organization is going to stand out from the crowd and succeed—you need to conduct research about the need for your nonprofit, as well as its feasibility.

The process of researching need, also known as conducting a needs analysis, involves identifying whether there is a space for your nonprofit in the vast sea of existing organizations. Here are a few things you’ll want to look into during this process:

Population or demographic data that illustrates that there is a clear unmet need for the work you intend to do

Nonprofit, for-profit, and government organizations that conduct the same or similar work

How your specific approach to your cause differs from, supplements, or supports the work done by similar organizations

A needs analysis may indicate that your nonprofit could be the solution to a problem in your community, but you can’t move forward until you’ve also assessed the feasibility of your nonprofit. After all, it’s one thing to want to make a difference in your community, and another thing entirely to have the resources and support to put that desire into action.

Here are a few things to consider when judging the feasibility of starting your nonprofit:

The costs of starting your organization: The cost of incorporating your nonprofit, securing your 501(c)(3) status, and registering as a charity in the state(s) where you plan to operate will vary from a few hundred dollars to thousands. But in addition to startup costs, you should also consider the costs of employing people to work for your nonprofit, leasing office space, and providing services to your community. Since you can’t begin fundraising until your charitable registration is completed and you have obtained 501(c)(3) status, you should consider where your initial startup funds will come from.

How much community support your organization will have: Are the people in your community excited and willing to support your nonprofit? Think about this not only in terms of fundraising dollars but also board and general volunteer service. If your organization doesn’t have people to back its mission, you’ll struggle to keep your organization afloat and effectively enact positive change.

How much time and energy you can commit to running your nonprofit: Running a nonprofit can soon become a full-time job, especially when your organization expands and you become an employer on top of a nonprofit leader. Ask yourself if you’re ready to commit to running the nonprofit, and whose help you will need to be successful.

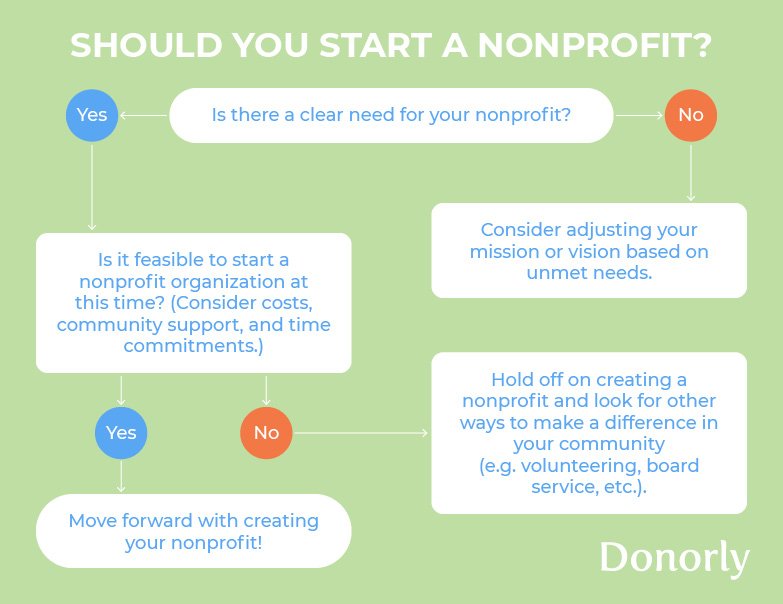

At this point, you should have a clear idea of whether or not starting a nonprofit is a viable solution for solving the issue you see in your community. Your needs and feasibility analyses will likely point you toward one of three conclusions:

There is a clear need for your nonprofit and its unique approach to the issue you want to solve. You also have the money, support, and time to help it succeed. You can move forward with creating your nonprofit.

There are other organizations doing work that meets the need of the target population, but starting a nonprofit is a feasible option for you. In this case, it may be time to pivot and adjust your mission and approach before moving forward with creating your nonprofit.

There are other organizations doing the work that meets the need of the target population, and you don’t currently have the financial or community support to help it succeed. You should hold off on creating a nonprofit and consider alternative ways to get involved with the cause you’re passionate about (more on this below).

If you are ready to move forward with your nonprofit, make sure to hold onto all of the data and insights you’ve collected during the research phase. This information will be invaluable as you begin growing your community of support and delivering your mission to beneficiaries.

2. Develop a strong foundation for your nonprofit to stand on.

Once you’ve determined that starting a nonprofit is the right move for you and your community, you can begin to build out your organization’s identity. While your nonprofit will evolve as time goes on, now is the time to root your organization in a strong foundation that will help you keep your end goals in sight.

At this stage, you should determine your organization’s:

Mission statement: Your mission statement is a short statement that tells the world why your nonprofit exists, what you do, and who you serve. Keep your mission statement succinct and digestible. Consider, for example, Days for Girls’ mission statement: “We increase access to menstrual care and education by developing global partnerships, cultivating Social Entrepreneurs, mobilizing volunteers, and innovating sustainable solutions that shatter stigma and limitations for women and girls.” From this statement, we learn what this nonprofit’s purpose is (to shatter stigma and limitations), who they serve (women and girls), and how they serve them (by developing global partnerships, cultivating Social Entrepreneurs, mobilizing volunteers, and innovating sustainable solutions). A mission statement like this can serve as a guiding light for your organization, helping you align all of your actions and services with your core purpose.

Vision statement: A vision statement describes what the world would look like if your nonprofit achieved all of its goals and no longer needed to exist. For example, Habitat for Humanity’s vision statement is simply, “A world where everyone has a decent place to live.” Teach for America offers another strong example: “All children in this nation will have an opportunity to attain an excellent education.” Days For Girls’ vision statement has similar strengths: “All women and girls will have equal access to quality healthcare.” These statements are short and simple, but their realization is much more complex. Your vision statement can give you a clear idea of what you’re working toward. In other words, a vision statement represents a world in which your nonprofit has been so successful that it puts itself out of business, meaning you’ve enacted lasting, positive change in your community!

Values: Your nonprofit’s values are the principles that guide all of your actions. They will likely become your workplace values as your team expands in the future. You have hundreds of options when it comes to choosing your values. For example, you might select respect, fairness, integrity, accountability, diversity and inclusion, teamwork, loyalty, trust, positivity, innovation, or collaboration. Avoid creating a laundry list of values, though. Obviously, some values will be implicitly adhered to, while there will be just a few that you want to highlight as part of your core identity.

Name and visual brand elements: Choosing a name for your nonprofit is an exciting step toward building a brand that people recognize and support. Your organization’s name should be unique and memorable, but it should also be indicative of what your mission is. For example, if your nonprofit is focused on saving stray cats in your community, you probably want to avoid a name like Helpers United, which sounds too generic and broad. Instead, you would want to go for something like Cat Rescue Corps or Cash4Cats. In addition to choosing your name, you should begin to identify the elements that will make up your visual brand. Your brand identity will evolve over time, but choosing basic elements like a color scheme, logo, and typography will give you a good start to developing a full-fledged brand guide. Consistently using these brand elements will help you appear more professional and trustworthy as you begin operating down the line.

Business plan: Similar to starting a for-profit business, you’ll need to create a business plan for your nonprofit that thoroughly outlines how your organization will operate. This will be a near-comprehensive document that will consist of an outline of your products, programs, and services, a marketing plan, an operational plan, an impact plan, a fundraising strategy, and a financial plan. You’ll rely on further market analysis and the data you gathered in the research step to compile your business plan, which will set you up to understand your mission better and to begin pulling in the support of investors, board members, and volunteers. For a deeper dive into nonprofit business plans, check out DonorBox’s guide to creating one.

Board of directors: A nonprofit board of directors is its governing body—the ultimate decision-making and management group that provides support and counsel in the financial, marketing, and legal areas of your nonprofit’s operations. Your board members will also often contribute financially to your mission and have a responsibility to assist in fundraising. Familiarize yourself with the duties and responsibilities of the board, and prepare to provide thorough board member training and set expectations for board member engagement. Then, identify individuals who can provide support in specific areas, bring special skills to the table, and are committed to seeing your mission succeed. Then, extend a board position to them. Having this official governing body will set you up to incorporate your organization in the next step.

Working through these important aspects of your nonprofit’s foundation can feel daunting. But, in the end, having a thorough mission and vision statement, values, brand name, business plan, and board of directors will help bring your nonprofit’s work to life. Plus, these foundation elements will set your organization up to function well and deliver value to your beneficiaries.

3. Lock down initial funding.

No matter how important your cause is or how determined your team is, the reality of nonprofit work is that you need money to get started. You may be bringing your own capital to the table, but if you’re looking for sources for initial funding, you typically have two options:

Secure a fiscal sponsor. By securing a relationship with a fiscal sponsor, your nonprofit can begin pulling in donations even when it isn’t yet recognized as a 501(c)(3) organization. Put simply, a fiscal sponsor is an existing nonprofit organization that collects charitable contributions on behalf of your budding organization and then grants them to you while still maintaining control over the funds. To learn more, check out the National Council of Nonprofits’ great overview of fiscal sponsorship.

Turn to your personal network. Your family, friends, and professional connections already know and trust you, and will likely be willing to supply some seed money for your nonprofit. When you solicit donations from individuals in your personal network, be sure to explain exactly what the money will be used for and to find meaningful ways to thank them for their contributions.

When you start your nonprofit, it may feel like funding is nowhere to be found. But by tapping into fiscal sponsorships and asking your personal network for support, you can get the startup money you need to succeed. And, once you’re legally able to start soliciting donations as a 501(c)(3) organization, the real fundraising work can begin!

4. Incorporate your nonprofit organization.

Next, you’ll need to file articles of incorporation in your home state to create an official nonprofit corporation. By doing so, you:

Officially register your nonprofit and secure its name

Limit your stakeholders’ liability

Set yourself up for federal tax exemption

Once your nonprofit is officially registered, you should also use Form SS-4 to apply for a federal employer identification number (EIN), which the IRS will use to identify your organization for tax purposes (whether you have employees or not). You’re also required to obtain an EIN to open a nonprofit bank account, which you’ll need to pay for the form fee when you file for your 501(c)(3) status.

This is where the steps of starting a nonprofit organization begin to vary by location. The process for incorporating your organization, as well as the fees associated with that process, will look different depending on your state. Check out Harbor Compliances’s directory of state incorporation requirements to get started.

5. File for federal tax-exempt status.

For your nonprofit to be exempt from paying federal and state income taxes, you need to secure tax-exempt status by filing as a 501(c)(3) organization. You must complete the filing within 27 months of forming your organization. To do so, you’ll need to pay a fee and file either Form 1023 or Form 1023-EZ (a streamlined version of Form 1023 that costs less to file). To be given 501(c)(3) status, your nonprofit will need to be incorporated and have an EIN, which is why Step 3 is so important.

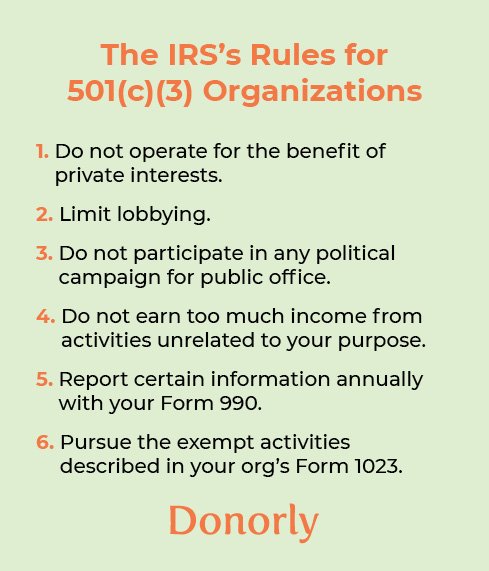

When you gain tax-exempt status, you have to maintain it by following rules set forth by the Internal Revenue Service (IRS). Specifically, your nonprofit must:

Not operate for the benefit of private interests. No part of your net earnings can benefit a private shareholder.

Limit how much lobbying it conducts.

Not participate in any political campaign for public office.

Not earn too much income from activities not substantially related to the organization’s exempt purpose.

Report financial information annually by filing a Form 990.

Pursue the exempt activities described in your organization’s Form 1023, or report deviations to prevent future problems.

Depending on whether you file Form 1023 or Form 1023-EZ, it could take anywhere from a few weeks to a year to receive your determination letter, the official recognition of your 501(c)(3) status by the IRS. You can check this IRS page for updates.

While (501)(c)(3) status takes care of your exemption from federal income taxes, you should also seek out tax exemptions at the state level. Some states will make your organization exempt from income tax after receiving your determination letter from the IRS. Others have different requirements for income tax exemption. Depending on the state, you may be able to obtain an exemption from corporate income, sales, use, and other types of taxes. Check out this directory from Harbor Compliance to see what exemptions are offered by the states you plan to operate in, and complete the necessary paperwork.

6. Maintain compliance at the state and federal levels.

Obtaining your 501(c)(3) status is a big milestone for your nonprofit, but doesn’t mean your work to stay compliant is completed. Here are a few areas of compliance to have on your radar so that your nonprofit can operate without any legal trouble:

Maintaining your federal tax-exempt status: Once you have your 501(c)(3) status, you never need to renew it with the IRS (unless you fail to file your Form 990 for three consecutive years). Instead, you’ll need to maintain it by adhering to the IRS rules outlined above and filing your Form 990 each year to prove you’re operating correctly as a nonprofit. Failing to do so may result in big fines or loss of your tax-exempt status.

Maintaining your state-level tax-exempt status: Some states may require you to renew your tax-exempt status, with time spans for renewals ranging from one to five years, so make sure to mark your calendar to avoid penalties. Regardless, you’ll need to file state tax forms annually, too.

Completing your charitable solicitation registration in each state you’re operating in: Most states require you to register as a fundraising organization before you can start asking residents for donations. This is an important consideration not just in your home state, but wherever you plan to solicit donations from, even with digital fundraising efforts. If you plan to register in multiple states at once, consider working with a compliance expert to streamline the process. Note that you’ll need to renew these registrations, typically on an annual basis. For a deeper dive into charitable registration and state-specific requirements, check out Labyrinth’s state-by-state guide.

Adhering to corporate registration requirements. Some states require that nonprofits register as an incorporated organization that does business in that state. You did this in your home state back in Step 3, but you also need to do so in states where you have paid staff or states that have specific corporate registration requirements (currently North Dakota and the District of Columbia). To file corporate registration in these cases, you’ll need to appoint a registered agent, an individual that lives or works in the state and can be responsible for representing your organization and accepting legal documents on behalf of your organization. You might, for example, appoint a staff member in that state, or rely on a commercial registered agent service to provide a registered agent for you.

Nonprofit compliance can be tricky and cause your team a lot of stress, especially as you’re just getting your nonprofit up and running. Remember two things to make the process easier.

One, keep thorough records. Legal and financial reporting will be much easier if you keep organized and transparent records.

Two, don’t be afraid to rely on the help of professionals. Whether you decide to work with a nonprofit consultant, a nonprofit CPA, or an attorney that you trust, getting expert help will reassure you that you’ve dotted all your i’s and crossed all your t’s so that you can get back to furthering your mission.

7. Begin your initial operations.

Once you’ve reached this step, your nonprofit is officially up and running, and is legally compliant on the state and federal levels. Now it’s time to dive into initial operations and start pulling in support for your cause!

Here are a few things to add to your to-do list as you start things off with your new nonprofit organization:

Hire and onboard your internal team.

Market your mission across various channels—including social media and your website.

Build relationships with community members, letting them know about opportunities to donate to your cause and to volunteer.

Invest in fundraising software.

Design your first fundraising campaigns based on your fundraising strategy.

Launch your programs and deliver services to your beneficiaries.

Keep thorough records and maintain compliance.

Once you’ve done all the footwork to start your own nonprofit organization, it can feel like you’ve crossed the finish line. And while you should definitely celebrate, starting your nonprofit is just the beginning. Now is the time to dig deep and begin making a difference in your community!

Frequently Asked Questions About Starting a Nonprofit

As you’re setting up your nonprofit, you’ll likely have a lot of questions. Let’s tackle a few of the most commonly-asked questions so that you have all of the information you need to keep the ball rolling.

-

Nonprofit organizations are business entities whose sole purpose is not to make revenue for their stakeholders, but to use their revenue to deliver services to a community in need.

Nonprofits can take the form of charities, advocacy groups, clubs, and associations, and typically champion a specific cause, such as animal welfare or pay equity.

-

While you can start a nonprofit organization by yourself, you’ll quickly need the help of other people to pull in support for your mission and to make a real difference for your beneficiaries. Plus, the IRS requires that all nonprofits have at least three board members.

So, while you can start a nonprofit on your own, be prepared to rapidly grow your team and network in order to do the most good for your beneficiaries.

-

When you first begin the process of creating a nonprofit, you’ll be doing a lot of paperwork. It can take anywhere from a few weeks to a year to receive your determination letter from the IRS confirming your nonprofit’s 501(c)(3) status, and a few weeks for a state to turn around initial charitable registration filings.

In a broader sense, it can take years for your nonprofit to be established enough to take off and pull in the fundraising dollars that will make a dent in the issue you’re seeking to tackle. Set yourself up for sustainable success by preparing to play the long game.

-

You should anticipate spending a few thousand dollars on government fees alone as you set out to create your nonprofit.

While you can start the process with no money in your pocket, you’ll likely need to turn to fiscal sponsorship and grants to cover the startup costs for your organization, especially if you want to launch your programs right away.

-

Nonprofit staff members can receive compensation for their work. Board members cannot. However, the board will be responsible for determining salaries for different positions and monitoring your organization’s overall financials.

For example, as the founder of your nonprofit, you can make a salary working for your nonprofit by stepping into the role of executive director, CEO, or any other paid position, like program coordinator, marketing manager, or volunteer coordinator.

-

If you determine that starting a nonprofit isn’t right for you at this time, there are a number of different ways you can be involved in good causes in your community.

For example, consider donating to a cause you care about, becoming a regular volunteer, or seeking out opportunities to serve on a nonprofit board. You can also explore other avenues for making a difference, like joining a professional association in your industry or pursuing a political office.

Advice From Experienced Nonprofit Consultants

At Donorly, our consultants recommend that nonprofits in the early stages of operating first gather enough seed money to get off the ground, then focus on marketing their missions to build a robust community of supporters. Building that community will allow for a base of small and mid-sized donations. As you build strong relationships with your community and these initial donors, you can begin building out a major gift program.

Once you’re to the point where your nonprofit is ready to make a plan for growth, consider working with a nonprofit consultant who can coach your team through the process. Note that as you research different consultants to partner with, many will offer services for larger, more fully-developed organizations, such as capital campaign counsel. Don’t discount these consultants just because you don’t yet need these services! By partnering with a consultant for the initial work of growing your organization, you can build a partnership that you can rely on whenever you need it, meaning you can tap into the other services now and in the future.

Wrapping Up

If you see an unmet need in your community and determine that setting up a nonprofit is the best way to meet that need, you’ll embark on an exciting journey full of ups and downs and personal fulfillment as you make a difference for those in need. Follow this guide to kickstart the process and ensure that you’re starting your nonprofit off on the right foot legally. Good luck!

Want to learn more about the world of nonprofits? Check out these additional resources, curated by the Donorly team:

Finding Major Donors: The Definitive Nonprofit Guide. Major donors are the donors who give your nonprofit the largest gifts, and are valuable members of your organization’s community. Learn everything you need to know about major donors in this guide.

Step-by-Step Fundraising Plan Template for Nonprofits. Ready to start putting together your fundraising plan? This template can help you ensure you don’t miss any details.

Peer-to-Peer Fundraising: Your Nonprofit’s Guide. A peer-to-peer fundraiser is a great way to pull in donations for your cause and turn your supporters into on-the-ground fundraisers. Learn the basics in this post.